The Sun Keeps Shining On The Solar Industry!

19 June 2019

Yesterday many solar stocks soared as US solar installations forecast were revised upward in latest U.S Solar Market Insight Report published by Wood Mackenzie and the Solar Energy Industries Association (SEIA). Key highlights of the report include:

US solar installations surpassed 2 million, only three years after reaching the 1 million installation milestone. US industry is expected to reach 3 million installations in 2021 and 4 million in 2023;

Q1 2019 recorded the largest Q1 ever in term of new installations, with 2.7 GWdc of Solar PV installed, a 10% increase from Q1 2018;

A total of 13 GWdc of Solar PV are expected to be installed in 2019, representing a 25% growth (vs. 12% for previous forecasts) compared to 2018;

Total installed US PV capacity is expected to more than double over the next five years.

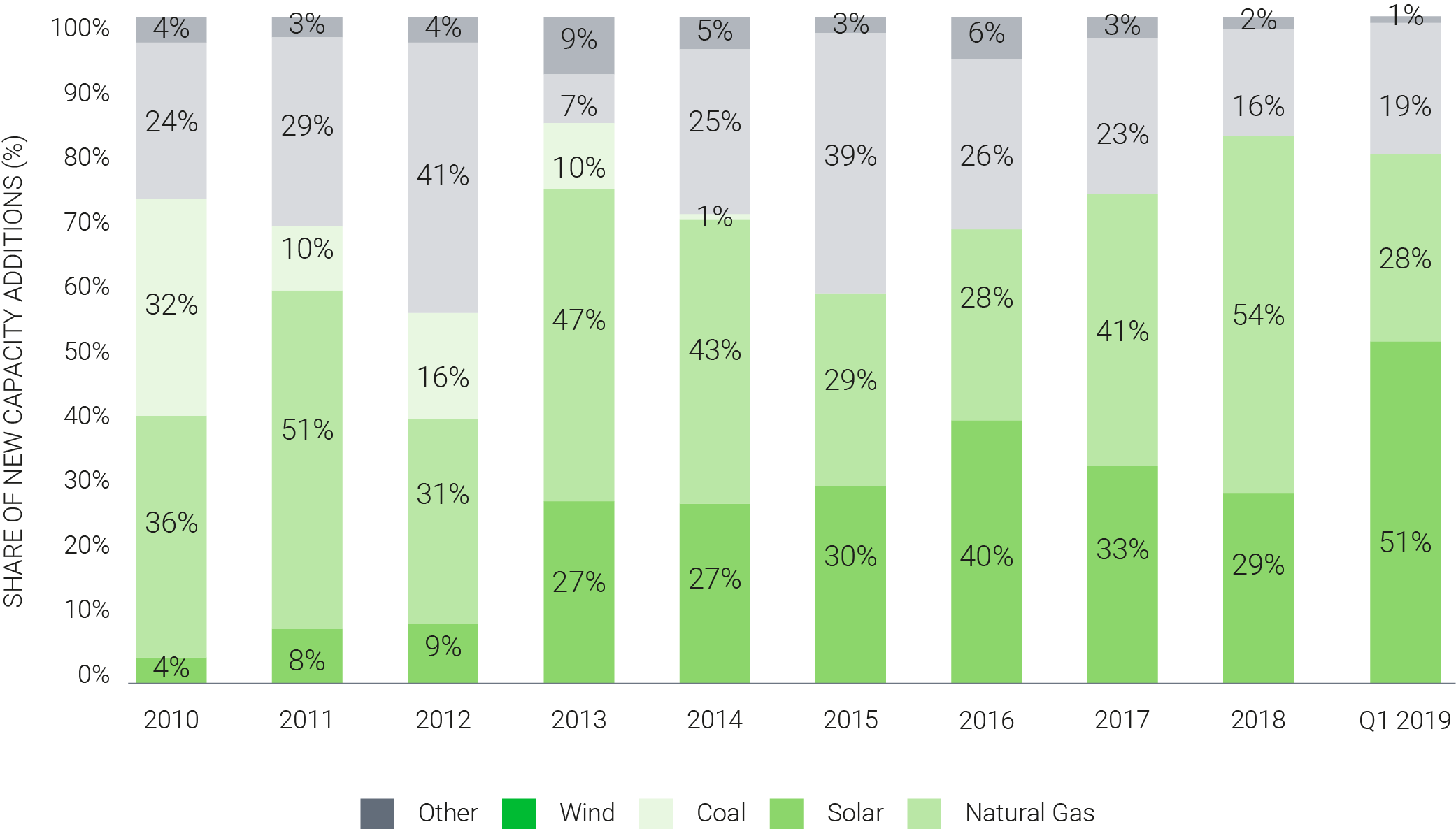

Despite the 25% tariffs on solar panels imports, Trump’s reluctance to renewable energies, and more generally the US-China trade war affecting imports of many Solar components, deployment of solar PV in the US remains high. As illustrated in below figure, during the first quarter Solar accounted for 51% of all new US power generating capacity, a record!

New U.S. electricity generating capacity additions, 2010-Q1 2019

Source: Wood Mackenzie Power & Renewables, FERC (All other technologies)

The rapid growth is partly driven by the improving economic competitiveness of Solar PV over other energy sources. In the US many utilities, cities, or states have already committed to 50% to 100% renewable energy, zero-carbon standards and coal plant retirements. Furthermore, the commitment from big corporations (Apple, Google etc.) to clean electricity remains another key driver to the massive deployment of solar panels.

On the residential level, we are also expecting an upcoming boost supported by new state regulations such as the Californian’s solar mandate on new homes which will require all new residential constructions to integrate solar PVs starting from 2020.

This rapidly growing trend is something that we have foreseen, and which is fully reflected in our asset allocation. In fact, solar-related stocks account for almost 20% of the Sustainable Future certificate.

Some notable names in our portfolio include: Sunpower (a manufacturer of highly efficient solar cells who is benefiting from a tariff exemption on the panels produced outside of the country) and Sunrun (the largest installer of residential solar and storage solutions in the US).

Yesterday’s news is confirming our view on the fundamentals of the Solar PV market opportunity. We strongly believe that this market will keep growing at a pace that exceeds Street’s highest expectations.

Explore:

Disclaimer

This report has been produced by the organizational unit responsible for investment research (Research unit) of atonra Partners and sent to you by the company sales representatives.

As an internationally active company, atonra Partners SA may be subject to a number of provisions in drawing up and distributing its investment research documents. These regulations include the Directives on the Independence of Financial Research issued by the Swiss Bankers Association. Although atonra Partners SA believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this report.

The information contained in these publications is exclusively intended for a client base consisting of professionals or qualified investors. It is sent to you by way of information and cannot be divulged to a third party without the prior consent of atonra Partners. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to its accuracy or completeness and it should not be relied upon as such.

Past performance is not indicative or a guarantee of future results. Investment losses may occur, and investors could lose some or all of their investment. Any indices cited herein are provided only as examples of general market performance and no index is directly comparable to the past or future performance of the Certificate.

It should not be assumed that the Certificate will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between the Certificate’s returns and any index returns.

Any material provided to you is intended only for discussion purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security and should not be relied upon by you in evaluating the merits of investing inany securities.