Optoelectronics: Enabling the future of communication

25 September 2019

Bottom line:

Optics will be more pervasive than ever as we approach traditional electronics physical limitations – SiPho will largely benefit as it represents the ideal platform to interface optics and electronics.

SiPho technology is reaching maturity in terms of cost efficiency, and it represents a better technological alternative to existing solutions.

SiPho: The Future Of Communications

- The semiconductor industry has long relied on silicon (Si) – a stable, resistant, and very abundant material – for building its components.

- Production know-how has developed and attained high-efficiency levels.

- Silicon chips use electrons to transmit data – despite the ability of the semiconductors industry to improve its capability of treating data exponentially, there are physical limits that impact bandwidth and power density, i.e., speed of transmission.

- That opened the way to optical systems (like optical fibers and lasers), which use photons, i.e., light, instead of electrons.

- Optical systems have a distinct advantage in long-distance communications.

- But the manufacturing of photonic devices is still very complex and costly.

- Photonic devices are made with exotic and costly materials, (e.g., erbium), and they are yet assembled in hundreds of pieces by hand.

- Photonic devices made from Silicon (SiPho) address this problem by combining the positive aspects of Si fabrication (high volume assembly, low cost) and those of optical system (lossless and efficient data transmission)

Example of SiPho Device: The Transceiver

- When a Netflix video is streamed, or a picture is posted on Facebook, the digital content flows through a transceiver (see image), a device that converts an electric signal into an optical one and vice versa.

- Transceivers are found at both ends of an optical fiber and are composed by the following elements:

- Optical modulators, the core; it modulates light with the shape of a given digital electric input

- Transmitters/receivers, they are simple laser/photodiodes that convert light into voltages and vice versa

- CMOS logic IC, circuitry used to encode and decode data

- SiPho transceivers bring two main advantages: Silicon modulators are extremely efficient and compact, and the fabrication methods allow to integrate all the above elements on the same wafer, therefore reducing overall size.

- The most appealing application for such devices is in the connections between racks and servers within a datacenter

- SiPho are a much better alternative to the currently and widely used copper wires, which suffer from bandwidth and heating limitations.

- This represents a high-volume market.

SiPho: The Biggest Opportunity In The PIC Market

- SiPho market is expected to reach $4bn in 2024, representing a CAGR of 44%.

- Units sold were 1.3mn in 2018 and are estimated to be 23.5 mn in 2024 (CAGR of 53%).

- The most significant driver will be datacenter interconnects (DCI).

- The market is very concentrated: Intel, Luxtera (Cisco) and Acacia have a combined 98% market share.

- New entrants are: Neophotonics, Inphi, Oclaro (Lumentum), Finisar, POET, Sicoya, to mention a few.

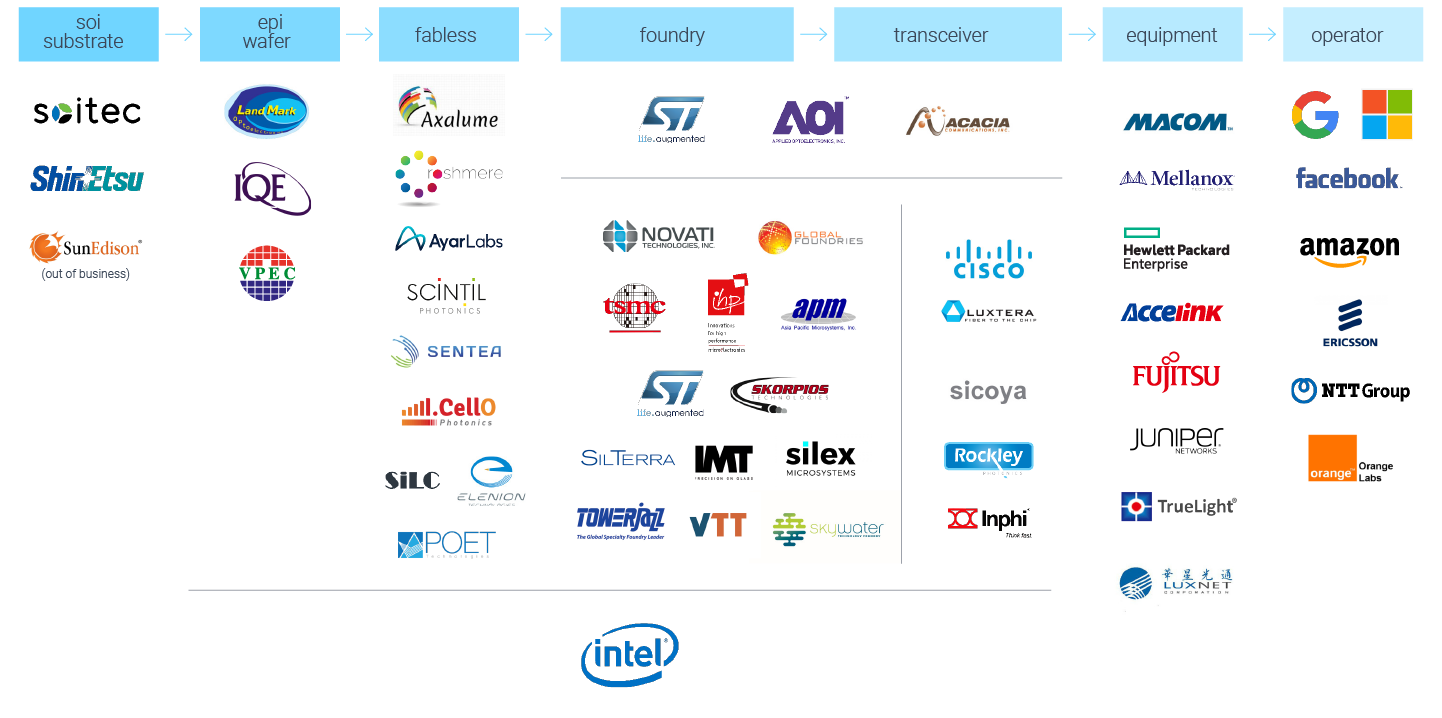

2019 Silicon Photonics Supply Chain*

* Non exhaustive list of companies

Catalysts:

- Datacenters: The world’s largest datacenters owners GAFAM and BAT are moving towards silicon photonics solutions because of the technology’s inherent advantages over legacy optics.

- Design ecosystem: TowerJazz, a foundry, Cadence, an EDA company, and Lumerical, a software company, have partnered to deliver a silicon photonics integrated process design kit.

- 5G: fiber and high-speed transceivers are required to reach the multi-Gbps speeds promoted by wireless carriers.

- Autonomous Vehicles: AVs will be filled with sensors, among which many will be optical, and SiPho will provide the performance and cost advantage.

- AI: Deep neural networks (DNNs) using SiPho have already been demonstrated at the research level and have reached the development phase. Energy greedy algorithms will find SiPho-based DNN as greener and faster alternatives to a classical accelerator.

Risks:

- Traditional electronics may keep a cost advantage if Moore’s law keeps on scaling, and physical limits are pushed over.

- Market cannibalization by big players (Intel, Cisco,…) might hinder the development of a competitive landscape.

- New materials, for instance two-dimensional materials, like graphene, or other semiconductors, like indium phosphide InP, represent a substitutional threat to Silicon.

Sources:

https://spectrum.ieee.org/semiconductors/optoelectronics/silicon-photonics-stumbles-at-the-last-meter, https://community.mellanox.com/s/article/what-is-silicon-photonics-x, https://ieeexplore.ieee.org/document/8540501, https://yole-i-micronews-com.osu.eu-west-2.outscale.com/uploads/2019/04/YD19015_Silicon_Photonics_SiPh_and_Photonic_IC_PIC_yole_sample.pdf

Explore:

Disclaimer

This report has been produced by the organizational unit responsible for investment research (Research unit) of atonra Partners and sent to you by the company sales representatives.

As an internationally active company, atonra Partners SA may be subject to a number of provisions in drawing up and distributing its investment research documents. These regulations include the Directives on the Independence of Financial Research issued by the Swiss Bankers Association. Although atonra Partners SA believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this report.

The information contained in these publications is exclusively intended for a client base consisting of professionals or qualified investors. It is sent to you by way of information and cannot be divulged to a third party without the prior consent of atonra Partners. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to its accuracy or completeness and it should not be relied upon as such.

Past performance is not indicative or a guarantee of future results. Investment losses may occur, and investors could lose some or all of their investment. Any indices cited herein are provided only as examples of general market performance and no index is directly comparable to the past or future performance of the Certificate.

It should not be assumed that the Certificate will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between the Certificate’s returns and any index returns.

Any material provided to you is intended only for discussion purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security and should not be relied upon by you in evaluating the merits of investing inany securities.

.png)

.png)

.png)

.png)